For a Buyer

Analysis of family needs

Search of properties to choose from

Pre-qualification for financing

Coordination of inspections

Application for financing

Search of hazard insurance

Contract negotiation

Assistance the day of closing

For a Seller

Market analysis to determine sales price

Marketing and advertising

Contract negotiation

Analysis of Net Proceeds

Assistance the day of closing

For Both

Consultation for re-financing of existing loans

Organization and management of investment packages

Hands-on training program to become a professional real estate agent.

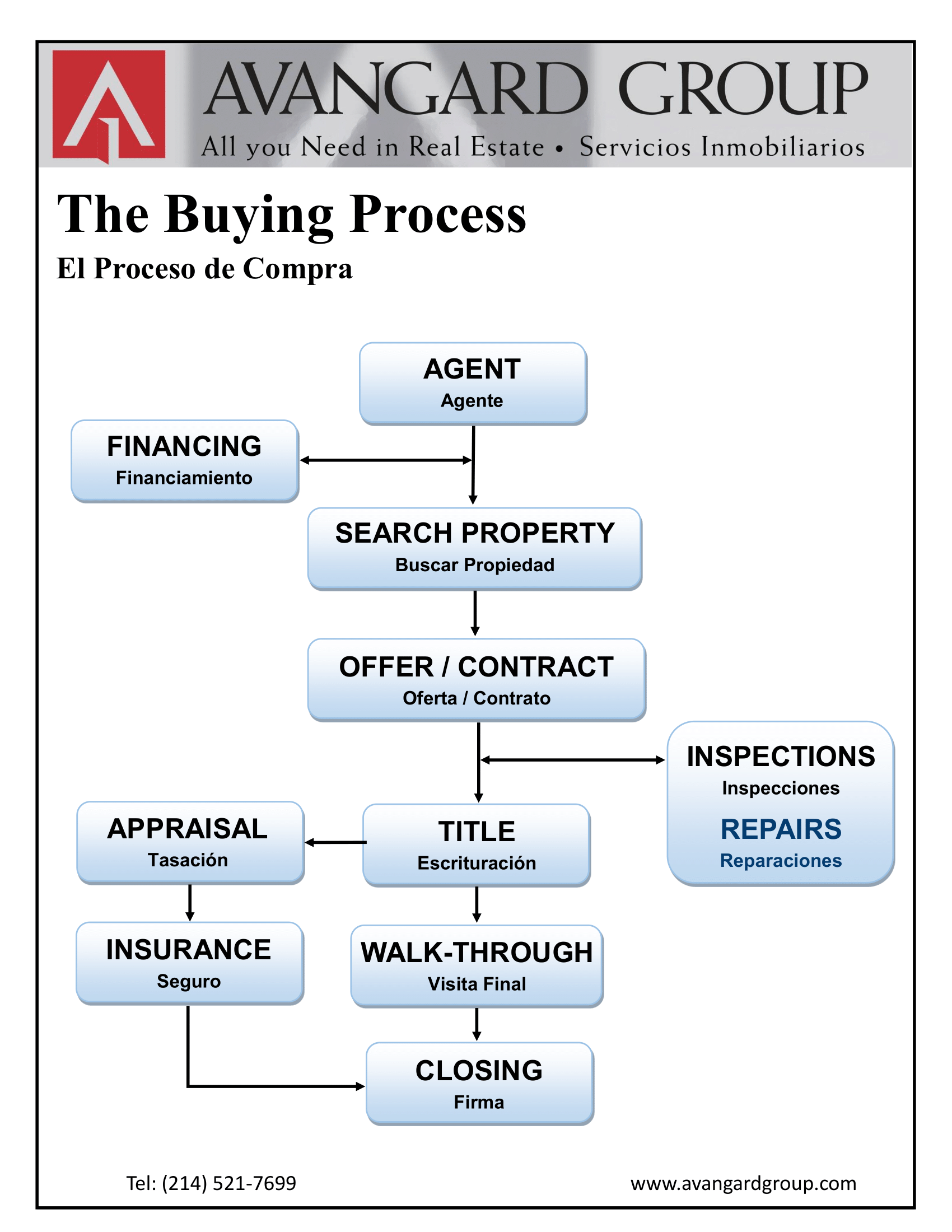

The Buying Process

The Agent:

An Avangard agent will be your guide through the process detailed hereinafter.

The Offer:

Document that reflects what you are willing to pay for the property and the conditions of sale.

The Contract:

Accepted offer, duly executed and dated.

The Title:

Deed of property generally prepared by title insurance company, after a thorough title search of public records.

The Financing:

Process to secure a loan for the purchase of the property. Our agent will help you choose among all the possibilities.

The Inspections:

Reports of the actual condition of the property, used to request the required repairs from the owner.

The Approval:

Underwriting of the loan package prepared with the information furnished by the applicant.

The Repairs:

Upon confirmation of the loan approval, the owner proceeds to do the required repairs prior to closing.

The Closing:

Execution of the loan documents, the note and the deed of trust, and disbursement of funds. Generally, the closing takes place at a title insurance company, which files the documents on public record.

Documents

Required Documents For a Mortgage Loan

Legal Status:

- Citizen or permanent resident.

- Driver’s License or identification.

- Social Security Number.

Place of Residence:

- Last 2 years address.

- Landlord’s name, address & telephone number.

Work History:

- Employer’s name, address & telephone number for the last 2 years.

- Copy of income tax return with W-2 or 1099 (last 2 years).

- Last pay stubs (30 days).

Financial Status:

- Bank account statements (last 3 months).

- Retirement accounts, 401K, etc.

- Other Income or Liabilities

The Selling Process

The Agent:

You hire Avangard to market and sell your property. An agent assigned to represent you through the process detailed hereinafter.

The Offer:

Document that reflects what a specific buyer is willing to pay for the property and under what conditions. While under negotiations with a particular buyer, any other offers are simultaneously submitted for your analysis.

The Contract:

Accepted offer, duly executed and dated.

The Title:

Deed of property generally prepared by a title insurance company. Your help will be required to clear the exceptions, should any appear after a title search is completed.

The Repairs:

Upon confirmation of the buyer’s approval for a loan, the required and previously agreed repairs must be done and completed prior to closing.

The Closing:

Execution of the warranty deed and disbursement of funds. Generally, the closing takes place at a title insurance company, where documents are notarized and filed on public record.